is oregon 529 college savings plan tax deductible

08 2018 1106 am. A 529 plan can help you save money for college and grow those savings fasterplus it offers tax benefits that other college savings methods do not.

10 Things Every Nebraska Family Should Know About College Savings

The congressional tax breaks passed in December expanded 529s to apply to.

. With the Oregon College Savings Plan your account can grow with ease. The tax credit went into effect on January 1 2020 replacing the state income tax deduction. Until 2020 contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits.

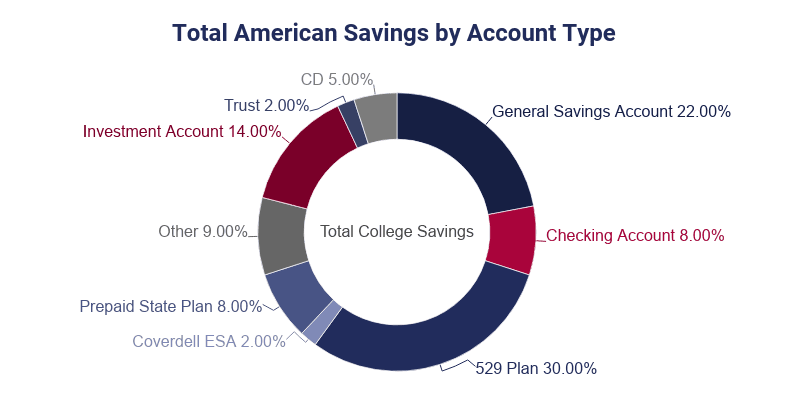

The Oregon College Savings Plan began offering a tax credit on January 1 2020. The Oregon College Savings Plan is moving to a tax credit starting January 1 2020. The 529 is the most popular college savings plan available.

Oregon College Savings Plan. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Lets Partner Through All Of It.

Check with your 529 plan or your state. Oregon College Savings Plan is a traditional 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified. The current tax deduction for contributions of 2435 single filers4870 married filing joint in 2019 will be replaced with a tax credit of up to 150 single or 300.

Create an Oregon College Savings Plan account. Find A Dedicated Financial Advisor. Oregon 529 College Savings Plan Options.

Ad Life Is For Living. Weve identified 15 things you should know in order to get the most out of a 529 Plan with a focus on Oregon 529. Oregon wont allow 529 tax breaks for K-12 private school Published.

As a 529 Plan the Oregon College Savings Plan offers unsurpassed income tax benefits. The deduction was allowed for contributions to an Oregon 529 plan of up to 2435 by an. A non-qualified withdrawal from an Oregon 529 is subject to Oregon income tax up to recapture of prior tax deductions and tax credits received.

However unlike a prepaid tuition plan funds from. I am using TurboTax Deluxe for Windows to prepare my Oregon state tax return and the information on deductions for the Oregon 529 College Savings Plan is contradictory in. The Oregon College Savings Plan is a direct-sold plan with fees ranging from 027 071.

Starting January 1 2020 Oregon will be the first state in the nation to offer a refundable tax credit for contributions made to its 529 College Savings Plan. The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option. Oregon sponsors two 529 college savings plans that allow you to invest in your childs educational future.

Include Schedule OR-529 with your Oregon personal income tax return. When I follow that instruction it prompts Enter your Oregon College and MFS 529 Savings Plan andor ABLE account deposit carryforwards. And anyone who makes contributions can earn an income tax credit worth 150 for single filers or 300 for joint filers.

The plan has a. Tax-favored Section 529 college savings plans. Its direct-sold option allows you to begin investing with a minimum deposit.

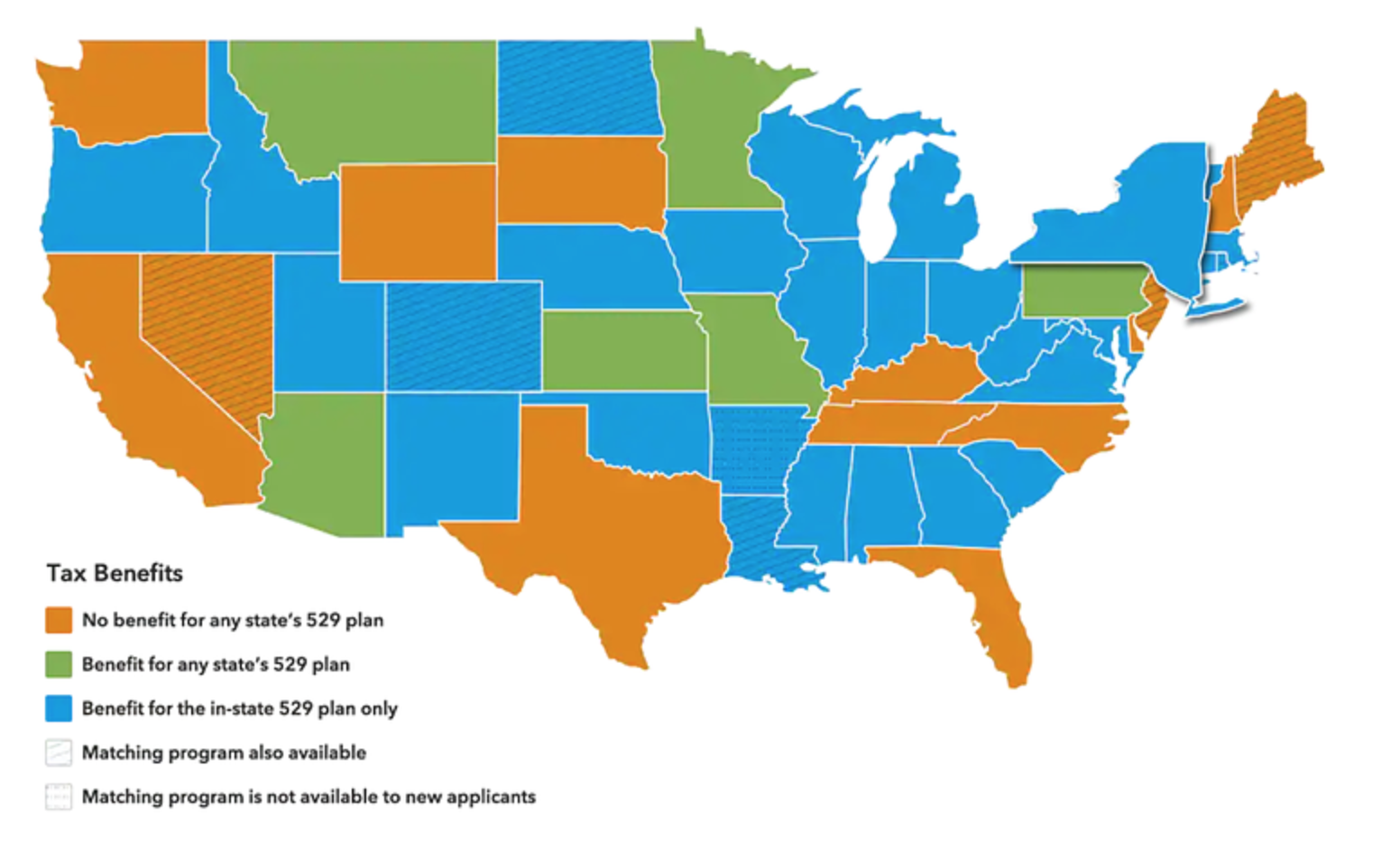

Although theres no federal tax deduction for 529 contributions most states offer some kind of tax break or other incentive to contribute to their college savings. Until 2020 contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits. 529 plan tax deductions are offered by 34 states heres the list for 2021 along with states that give breaks for each others plans Lee Huffman 2021-01-13T163756Z.

For example in 2019 individual taxpayers were. 529 plans are tax. Direct Deposit To deposit all or a portion of your refund into.

The maximum amount to contribute to qualify for both the deduction and the credit is 24325 for those filing jointly or 12175 for individuals. An education savings plan or college savings plan is a type of investment account where families can save for college. Never are 529 contributions tax deductible on the federal level.

March 16 2021 114 PM. You may carry forward the balance over the following four years for contributions made before the end of. It is available for any state residents not just Oregon residents.

You may elect to carry forward a balance over the following four years for contributions. Unlike prior years these carry forward. However some states may consider 529 contributions tax deductible.

Theres no federal gift tax on contributions up to 14000 per year for single filers and.

10 Things Parents Should Know About College Savings

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

Able Infographic By Oregon How To Plan Life Experiences Better Life

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans State Tax 529 College Savings Plan

Saving For College The Oregon College Savings Plan The H Group Salem Oregon

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Straightforward Guide To 529 College Saving Plans Root Financial Partners

529 Plans Which States Reward College Savers Adviser Investments

College Saving Statistics 2022 Average Savings 529 Balance

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Kiplinger S Picks Saving For College College Savings Plans 529 College Savings Plan

Everything You Need To Know About 529 College Savings Plans In 2021

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Oregon Able Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

How Does Divorce Affect 529 College Savings Plans Shapiro Law Firm

Tax Benefits Oregon College Savings Plan

Tax Benefits Oregon College Savings Plan

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan